Public Private Partnerships have become a major driving factor behind infrastructure development and social service delivery worldwide. This is essential in facilitating the designs, construction, operation, and maintenance of critical infrastructure projects and can directly affect social services projects including health, education, housing, or sanitation.

In this blog, we will explore different PPP models, investment strategies, and the benefits of such partnerships while shaping sustainable communities through infrastructure development, all illustrated by global examples. Furthermore, we will be able to understand the role of international funding agencies, such as the World Bank and other development banks in PPPs for infrastructure and social services projects.

What is a Public Private Partnership (PPP)?

A Public Private Partnership (PPP) is a collaborative agreement between government entities and private companies to deliver a service or a project. In a Public Private Partnership, the private sector is responsible for financing, designing, and building the infrastructure, and occasionally managing the operation and maintenance of assets, whereas the public sector provides performance based fundings, exercises regulatory control, and ensures that underserved populations are reached.

The integration of PPPs into construction and infrastructure sectors has several benefits, including improved efficiency, and access to private sector’s expertise. In the context of social services, PPPs play a critical role in ensuring that the construction of essential infrastructure supports long-term societal goals, such as enhanced quality of life, economic growth, and social equity.

Common PPP Models in Infrastructure and Construction Projects

Different types and modes of PPPs exist catering to various kinds of projects in infrastructure. The chosen model depends upon the project type, extent of involvement by the public sector, and the percentage of allocation of risk sharing between public and private sectors.

1. Hybrid Annuity Model (HAM)

The Hybrid Annuity Model (HAM) is one of the popular PPP models used for infrastructure projects in India and several other countries. Under this model, the government provides a part of the funding of the project upfront, while the private sector partners provide the remaining amount. In return, the private party gets annuity payments from the government over a specific period, based on the successful completion and operation of the project.

HAM is ideal for projects where the public sector shares the cost burden of infrastructure development on a large scale while still offering incentives for private investment and expertise. It is utilized in the construction of highways, bridges, and other infrastructure critical to supporting social services.

2. Annuity Model

The Annuity Model is the one where the private sector undertakes the construction, operation, and maintenance of the infrastructure for a predetermined period. The public entity pays the private firm through a fixed annual payment for services. This model is quite useful for projects with long lifespans in operation. Such projects include toll roads, water supply systems, and healthcare facilities.

The Annuity mode has the benefit of diffusing financial risks to allow private investors to receive benefits only when a project is completed as per required standards and goal is achieved, therefore guaranteeing quality infrastructure deliveries at appropriate times.

3. Build-Operate-Transfer (BOT)

BOT is one of the most common PPP structures used in large infrastructure projects. The private sector is responsible for designing, financing, building, and operating a facility for a specified period. Upon the end of the operational period, the facility is transferred to the public sector.

BOT projects are often used on infrastructure projects like airports, roads, and water treatment plants whereby the private sector can operate the project before delivering it to the government. The private sector ensures that such infrastructure is maintained in good standards through long-term financing.

4. Build-Own-Operate-Transfer (BOOT)

The BOOT model further develops the BOT concept to provide the private partner with ownership of the infrastructure in the operation phase. The right of the public sector remains for eventual ownership at the end of the operational period. This model is more effective for projects that will develop assets with long life spans such as power plants and urban transportation systems.

BOOT arrangements are often observed in projects where private investment is critical to meet both the construction and maintenance requirements over long periods. In social services, this model ensures that projects, like healthcare and educational facilities, are built to last and serve the community for many years.

5. DBFOT (Design-Build-Finance-Operate-Transfer)

In the DBFOT model, the private partner is responsible for the project lifecycle, including design, construction, financing, and operation. The model is often used in projects where high levels of expertise and innovation are required. This model also allows the public sector to pass on its financial risk to the private sector, where it has to make payments periodically as a performance payment and service delivery.

DBFOT is commonly used in large-scale social infrastructure projects, like hospitals, schools, and public housing developments, wherein the private sector is encouraged to provide high-quality solutions that are sustainable for the benefit of the community.

The Role of Funding Agencies in PPPs

International funding agencies involved in large infrastructure projects typically include the World Bank, International Finance Corporation (IFC), Asian Infrastructure Investment Bank (AIIB), Asian Development Bank (ADB), and the European Investment Bank (EIB). Usually, they finance or provide guarantees to minimize risks and aid both public and private sectors in taking on projects that would otherwise be too high-risk or financially unfeasible.

These agencies provide loans, guarantees, equity participation, and blended financing in the form of a mix between concessionary finance and market-based funding in order to provide a secure PPP implementation environment. The construction of projects on social grounds, especially concerning health, education, housing, and transportation infrastructure projects, is considered only when there is full involvement by these agencies.

Examples of PPP projects involving the funding agencies:

1. Kenya – Nairobi's Road Infrastructure Development

In Kenya, the World Bank and the African Development Bank (AfDB) have collaborated with the Kenyan government in several mega road infrastructure projects, such as the upgrading of Nairobi's roads under the PPP model. The projects are concerned with road network expansion and improvement that should pass through the city and the outer area, and this aims at reducing congestion and improving transport services that directly affect economic growth and social welfare.

This collaboration ensures sustainable development of infrastructure, given that the private sector assumes responsibility for the construction and operation of roads. All these PPPs will contribute to the success of public services such as transportation, trade, and economic development.

2. India – Mumbai Metro Line 5

The Mumbai Metro Line 5 is one of the best examples of a PPP infrastructure project with extensive participation from international funding agencies such as the World Bank and the Asian Infrastructure Investment Bank (AIIB). This project will help to improve the metro connectivity between different urban and suburban areas and reduce congestion while offering efficient transportation options to millions of people.

This, however, was supported through a financial package by the World Bank, while on its part, the AIIB extended assistance for environmental and social safeguards to ensure international standards in sustainability. The project was very important to improve social services through cheap and reliable public transport.

3. Morocco – Noor Ouarzazate Solar Complex

Morocco's Noor Ouarzazate Solar Complex is among the largest renewable energy developments; it is supported through a Public Private Partnership with major financial commitments from the World Bank and International Finance Corporation (IFC).

The project is jointly financed by private sector investors and international development funding World Bank, and lending, as well as insurance guarantees from the Multilateral Investment Guarantee Agency (MIGA) of the World Bank Group. The Noor Solar Complex will supply electricity to over one million people and positively contribute to social welfare by opening up access to energy while improving carbon emissions.

4. Sri Lanka – Colombo Port Expansion Project

It is considered the largest infrastructure project in Sri Lanka and was developed under a PPP framework with financial backing from the Asian Development Bank. This project includes the development of Colombo South Port and the associated container terminals, with increased capacity to handle bigger vessels.

Risk assessments and financing were supported financially by the ADB together with technical expertise. This kind of PPP model has done very much to boost maritime trade in Sri Lanka which has contributed to that economy and improved access to most goods and services, mainly food, medicine, as well as raw materials, for local industries.

5. Nepal – Upper Tamakoshi Hydroelectric Project

The Upper Tamakoshi Hydroelectric Project in Nepal is another PPP project where the World Bank and the Asian Development Bank (ADB) have provided critical support. This hydropower project is located in the remote areas of Nepal and aims to enhance the country’s energy production, reducing reliance on imported energy.

The World Bank and ADB helped structure the financing of the project through a combination of loans and grants, which enabled the government to engage private investors to manage the development. This project will improve energy access for millions of people, particularly in rural and underserved areas, contributing significantly to social services by ensuring a more reliable and sustainable electricity supply.

Role of Public Private Partnerships in Infrastructure Development for Social Good

Public Private Partnerships (PPPs) are growing increasingly crucial to driving social well-being directly by developing essential infrastructure. The combination of the strengths of both public and private sectors in a PPP increases the quality, accessibility, and sustainability of such vital infrastructure in underpinning social services while creating lasting positive impacts within communities.

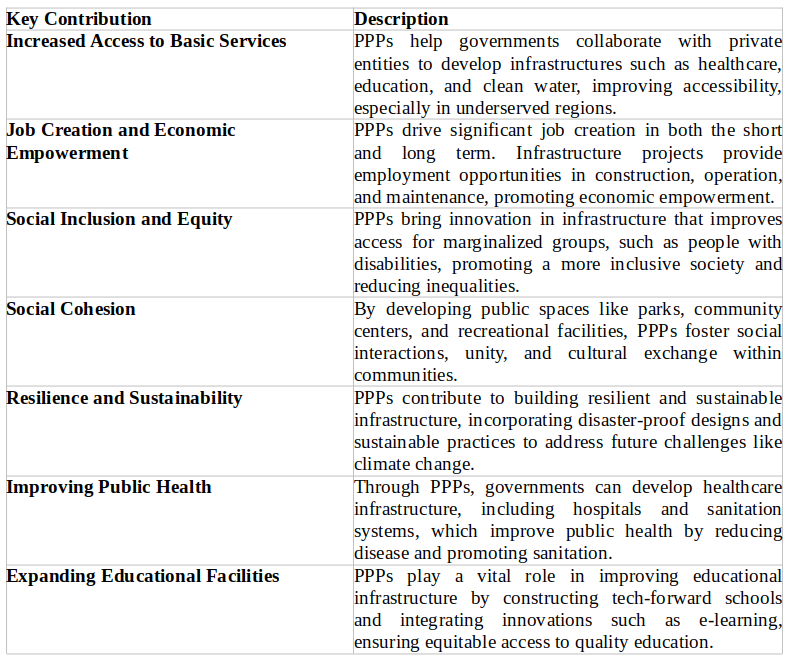

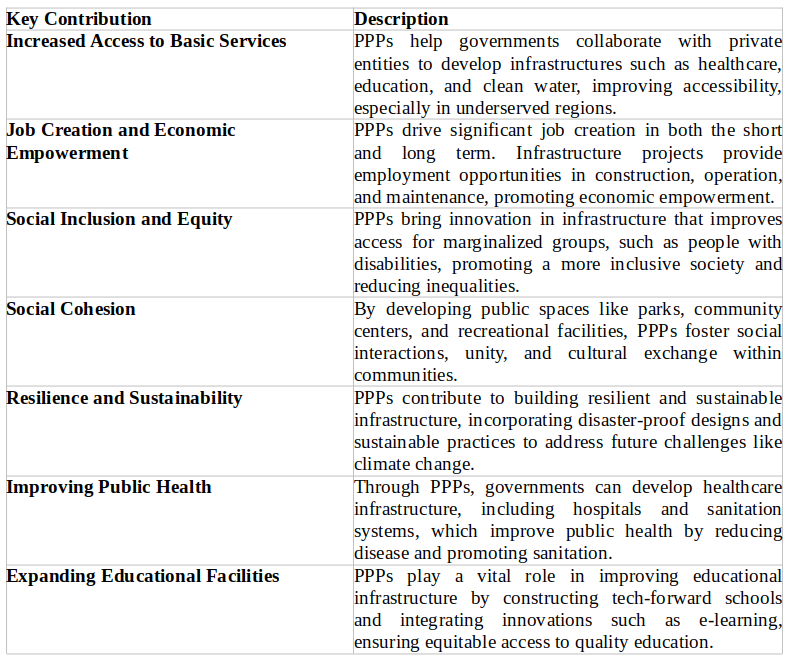

Here’s how PPPs contribute to social benefits through infrastructure development:

Conclusion

Public Private Partnerships play a great role in driving infrastructure development, especially in the social services sectors, such as healthcare, education, and transportation. By bringing out the best of the public and private sectors, PPPs help in delivering necessary services, boosting economic development, and ensuring fair and equal access to infrastructure. The implementation of Public Private Partnerships (PPPs) is evolving with a cutting-edge platform like Tender Grid, which provides access to procurement opportunities globally, and enhances wider participation, especially in infrastructure and social services sectors. By digitizing the discovery of projects tender, Tender Grid enhances efficiency, and accessibility, making it easier for both public and private sectors to participate on more projects. It plays a key role in streamlining the search for tenders, track and update for changes in selected tenders, and ensuring wider competition. Tender Grid is a key enabler for the success of PPPs.

References:

- https://ppp.worldbank.org/public-private-partnership/sites/default/files/2022-06/AICD-Kenya-country-report.pdf

- https://www.aiib.org/en/projects/details/2024/_download/India/AIIB-Approval-Project-Document-Mumbai-Metro-Line-5-P000365.pdf

- https://ppp.worldbank.org/public-private-partnership/sites/ppp.worldbank.org/files/2022-02/MoroccoNoorQuarzazateSolar_WBG_AfDB_EIB.pdf

- https://www.adb.org/sites/default/files/evaluation-document/219336/files/pvr-467_6.pdf

- https://documents1.worldbank.org/curated/en/552731540818686241/pdf/Summary-Report.pdf